Pengaruh Struktur Aktiva, Debt to Assets Ratio, Return on Equity Ratio dan Dividend Payout Ratio Terhadap Price Book Value

Studi Empiris pada Perusahaan Non-Perbankan yang Tergabung dalam Indeks LQ45 di Bursa Efek Indonesia Periode 2019-2023

DOI:

https://doi.org/10.55606/jimas.v3i3.1466Keywords:

Asset Structure, Debt to Asset Ratio, Return On Equity, Dividend Payout Ratio, Price Book ValueAbstract

This research examines the impact of Asset Structure, Debt to Assets Ratio, Return on Equity, and Dividend Payout Ratio on Price to Book Value. It focuses on non-banking firms listed in the LQ45 Index on the Indonesia Stock Exchange from 2019 to 2023. Utilizing secondary data and purposive sampling, the study analyzed a sample of 16 non-banking companies out of a population of 38. Multiple linear regression analysis was conducted using SPSS version 22. The results show that Debt to Assets Ratio, Return on Equity, and Dividend Payout Ratio affect Price to Book Value, while Asset Structure does not. Asset Structure does not..

References

Aisyah, Ruma, Z., Anwar, Tawe, H. A., & Aslam, A. P. (2024). Pengaruh Kebijakan Dividen Dan Profitabilitas Terhadap Nilai Perusahaan Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia Tahun 2017-2022. Jurnal Akuntansi STIE Muhammadiyah Palopo, 3(2), 608–620. http://journal.stiem.ac.id/index.php/jurakun/article/view/523%0Ahttp://journal.stiem.ac.id/index.php/jurakun/article/download/523/344

Anita, S. Y., EDT, R., Suryantari, E., Nurhayati, N., & Yucha, N. (2023). manajemen keuangan (m. wardana (ed.)). https://www.google.co.id/books/edition/manajemen_keuangan/oaq5eaaaqbaj?hl=id&gbpv=1&dq=rumus+debt+to+asset+ratio&pg=pa133&printsec=frontcover

Aqidah, F., Rimawan, M., & Nurulrahmatiah, N. (2023). Pengaruh Ukuran Perusahaan dan Return Of Equity ( ROE ) Terhadap Nilai Perusahaan Sub Sektor Rokok Yang Terdaftar di bursa efek Indonesia(BEI). 16(2), 421–429.

Colline, F. (2022). The Mediating Effect of Debt Equity Ratio on The Effect of Current Ratio, Return on Equity and Total Asset Turnover on Price to Book Value. Jurnal Keuangan dan Perbankan, 26(1), 75–90. https://doi.org/10.26905/jkdp.v26i1.6882

Fahrisal, M., & Paranita, S. E. (2024). Pengaruh Kinerja Finansial Terhadap Price Book Value Perusahaan Telekomunikasi. jurnal manajemen dan inovasi (manova), 7(1), 65–78. https://doi.org/10.15642/manova.v7i1.1603

Grediani, E., & Dianingsih, M. (2022). Struktur Aset, Ukuran Perusahaan, Likuiditas, Profitabilitas, dan Nilai Perusahaan. E-Jurnal Akuntansi, 32(4), 877. https://doi.org/10.24843/eja.2022.v32.i04.p04

Gunardi, A., Alghifari, E. S., & Suteja, J. (2022). Keputusan Investasi Dan Nilai Perusahaan (E. A. Firmansyah (Ed.)). https://www.google.co.id/books/edition/keputusan_investasi_dan_nilai_perusahaan/6k2meaaaqbaj?hl=id&gbpv=1&dq=return+on+equity+adalah&pg=pa24&printsec=frontcover

Hasibuan, L., Daulay, P., Nasution, E., & Lestari, S. (2023). Analisa Laporan Keuangan Syariah. https://www.google.co.id/books/edition/analisa_laporan_keuangan_syariah/khxoeaaaqbaj?hl=id&gbpv=1&dq=rumus+return+on+equity&pg=pa180&printsec=frontcover

Lilia, W., Nasution, S., Savitri, D., & Ginting, W. (2024). The effect of liquidity, asset structure, company size and total asset turnover on capital structure in food and beverage subsector manufacturing companies listed on the indonesian stock exchange for the period 2019-2022. 7.

Mahendra, Y. I., Maliah, M., & Mursalin, M. (2023). Pengaruh Struktur Modal dan Struktur Aset Terhadap Nilai Perusahaan Pada Perusahaan Asuransi Yang Terdaftar di Bursa Efek Indonesia (BEI) Tahun 2016-2020. Jurnal Media Wahana Ekonomika, 20(3), 623–636. https://doi.org/10.31851/jmwe.v20i3.13502

Mahirun, Ayuningrum, A. P., & Prasetiani, T. R. (2023). Pengaruh Kebijakan Deviden, Struktaur Modal, Set Peluang Investasi, Dan Profitabilitas Terhadap Nilai Perusahaan. JAKA Jurnal Akuntansi, Keuangan dan Auditing, 4(2), 33–47.

Ningrum, E. P. (2022). Nilai Perusahaan (Konsep dan Aplikasi). https://www.google.co.id/books/edition/nilai_perusahaan_konsep_dan_aplikasi/egbzeaaaqbaj?hl=id&gbpv=1&dq=rumus+price+book+value&pg=pa24&printsec=frontcover

Novianti, F. D. N., Barnas, B., & Djatnika, D. (2022). Pengaruh Dividend Payout Ratio dan Debt to Asset Ratio terhadap Price to Book Value pada PT Astra International Tbk. Indonesian Journal of Economics and Management, 2(3), 561–572. https://doi.org/10.35313/ijem.v2i3.3750

Rinaldi, R., & Oktavianti, N. (2023). Pengaruh Total Aset Turnover, Debt To Asset Ratio Dan Return On Asset Terhadap Nilai Perusahaan Pada Perusahaan Sub Sektor Farmasi Yang Terdaftar Di Bursa Efek Indonesia (BEI) Tahun 2016-2020. Ikraith-Ekonomika, 6(2), 209–221. https://doi.org/10.37817/ikraith-ekonomika.v6i2.2353

Satria, R., & Sari, R. (2024). Pengaruh Current Ratio (CR), Debt To Asset Ratio (DAR) dan Return On Equity (ROE) terhadap Price To Book Value (PBV) pada Perusahaan Manufaktur Sub Sektor Makanan dan Minuman yang Terdaftar di Bursa Efek Indonesia Periode 2018-2022. Reslaj: Religion Education Social Laa Roiba Journal, 6(4), 2388–2399. https://doi.org/10.47467/reslaj.v6i4.1327

Sudaryana, B., & Agusiady, R. (2022). Metodologi Penelitian Kuantitatif. https://www.google.co.id/books/edition/metodologi_penelitian_kuantitatif/okdgeaaaqbaj?hl=id&gbpv=1&dq=metode+penelitian&printsec=frontcover

Sunaryo, D. (2021). Manajemen Investasi dan Portofolio. https://www.google.co.id/books/edition/manajemen_investasi_dan_portofolio/lvvceaaaqbaj?hl=id&gbpv=1&dq=rumus+dividend+payout+ratio&pg=pa55&printsec=frontcover

Thian, A. (2022a). Analisa Fundamental (A. Thian (ed.)). https://www.google.co.id/books/edition/Analisa_Fundamental/OOZ-EAAAQBAJ?hl=id&gbpv=1&dq=dividend+payout+ratio+merupakan&pg=PA104&printsec=frontcover

Thian, A. (2022b). Analisis Laporan Keuangan. https://www.google.co.id/books/edition/analisis_laporan_keuangan/lvfzeaaaqbaj?hl=id&gbpv=1&dq=pengertian+debt+to+assets+ratio+menurut+(alexander+thian,+2022&pg=pa77&printsec=frontcover

Yeni, F., Hady, H., & Elfiswandi. (2024). Nilai perusahaan berdasarkan determinasi kinerja keuangan. https://www.google.co.id/books/edition/nilai_perusahaan_berdasarkan_determinan/j9veaaaqbaj?hl=id&gbpv=1&dq=pengertian+teori+trade+off&pg=pr3&printsec=frontcover

Downloads

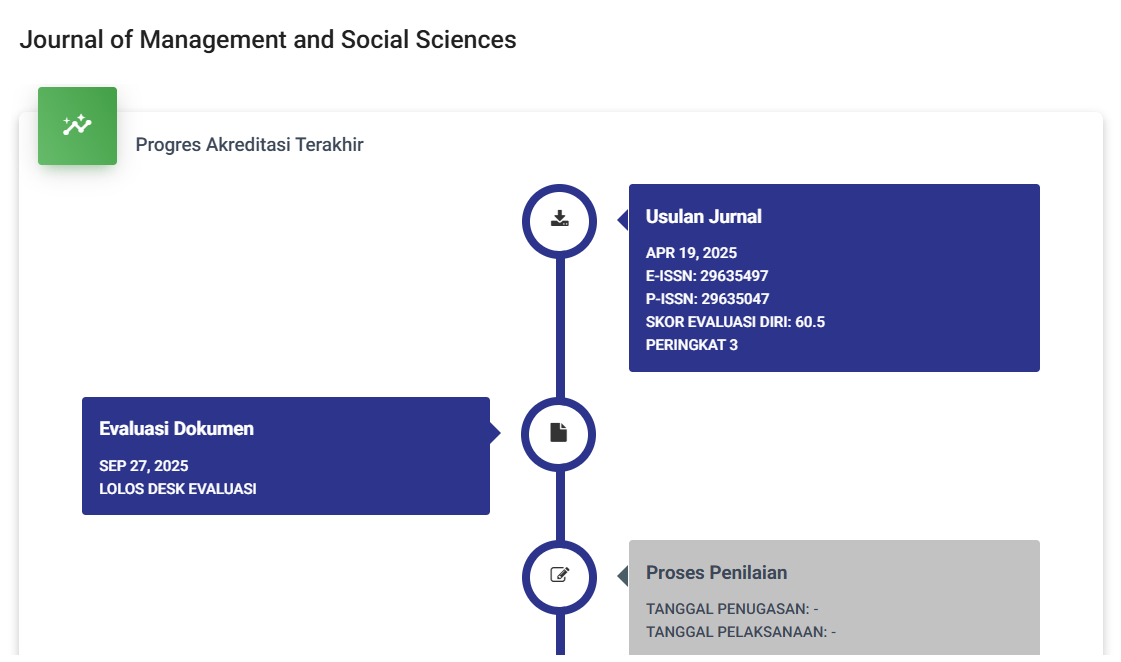

Published

Issue

Section

License

Copyright (c) 2024 Juli Ani, Slamet Mudjijah

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.