Analisis Perbedaan Pengaruh Probabilitas (ROA) Terhadap Harga Saham Sebelum Dan Saat Pandemi Covid-19

(studi kasus pada perusahaan Telekomunikasi)

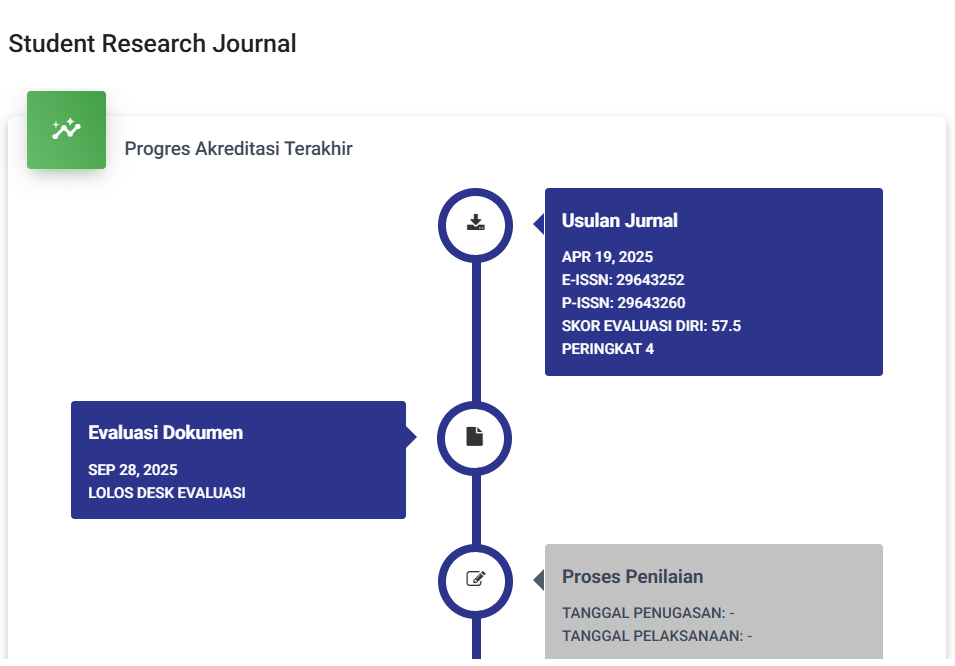

DOI:

https://doi.org/10.55606/srjyappi.v1i5.709Keywords:

Return on Assets, Stock Prices, PandemicAbstract

The Covid-19 pandemic phenomenon also has an impact on the economic and business sectors. The IHSG trend has decreased since the Covid-19 pandemic case was announced. Rises and falls in share prices can be caused by financial performance factors. This research examines whether there is a difference in the influence of ROA on share prices both before and during the pandemic. The objects in this research are all telecommunications companies, with a purposive sampling method, the sample obtained in this research was 13 companies, namely telecommunications companies that published share prices before the Covid-19 pandemic as many as 13 and during the Covid-19 pandemic as many as 13. Using this method Simple linear regression shows that ROA has an effect on stock prices before the pandemic, and ROA has an effect on stock prices during the pandemic. ROA for telecommunications companies was 12.7% before the pandemic, increasing to 24.2% during the pandemic. This means that a pandemic event can increase the relationship between ROA and share prices.

References

Awalina, P., Suaidah, I., & Kusumaningarti, M. (2021). Analisis Pengaruh Faktor Fundamental terhadap Harga Saham Sebelum dan Selama Pandemi Covid-19. JURNAL AKUNTANSI DAN BISNIS : Jurnal Program Studi Akuntansi, 7(2), 109– 117. https://doi.org/10.31289/jab.v7i2.5023

Badan Pusat Statistik. (2021). Pertumbuhan Ekonomi Indonesia Triwulan IV-2020. Jakarta : Badan Pusat Statistik

Brigham, E. F., & Houston, J. F. (2019). Dasar-Dasar Manajemen Keuangan (14th ed.). Salemba Empat, 2

Elita, I., Wardianto, K. B., & Harori, M. I. (2020). Analisis Pergerakan Saham Perusahaan Sub Sektor Farmasi Menggunakan Indikator Bollinger Band Di Tengah Pandemi Covid-19. Jurnal Perspektif Bisnis, 3(2), 77–88.

Fahmi, I. (2018). Pengantar Manajemen Keuangan. Alfabeta

Febriantika,Y. J. A., Prasetyo, T. J., & Dharma, F. (2021). Analysis of Financial Performance and Company Value Before and during the Covid-19 Pandemic Study on Manufacturing Companies Listed on IDX. Journal Dimensie Management and Public Sector 2(3) : 62-68. https://doi.org/10.48173/jdmps.v2i3.115

Gemala, N. (2022). Analisis Perbedaan Harga Saham, Likuiditas, dan Profitabilitas Pada Perusahaan Retail Antara Sebelum Dengan Masa Covid-19. E-JURNAL EKONOMI DAN BISNIS UNIVERSITAS UDAYANA, 11(05), 547–556

Hayat, A., Noch, M. Y., Hamdani, & Rumasukun, M. R. (2018). Manajemen Keuangan (1st ed.)

Hilaliyah, I., Gurendrawati, E., & Handarini, D. (2022). Analisis Komparatif Kinerja Keuangan Sebelum dan Saat Covid-19 pada Perusahaan yang Terdaftar di BEI. Jurnal Akuntansi Dan Auditing, 13(1), 97–108. https://www.neliti.com/id/publications/136376/analisis-pengaruh-rasiokeuangan-terhadap-perubahan-laba

Idris, A. (2021). Dampak Profitabilitas dan Likuiditas terhadap Harga Saham pada Perusahaan Makanan dan Minuman di Indonesia. Jurnal Manajemen Kewirausahaan, 18(01), 11–20. https://doi.org/10.33370/jmk.v18i1.515

Ilahude, A. P., Maramis, B. J., & Untu, N. V. (2021). Analisis Kinerja Keuangan Sebelum dan Saat Masa Pandemi Covid-19 pada Perusahaan Telekomunikasi yang Terdaftar di BEI. Jurnal EMBA, 9(4), 1144–1152.

Jogiyanto, H.M. (2010). Teori Portofolio dan Analisis Investasi. Edisi Ketujuh. BPFE. Yogyakarta.

Junaidi, L. D., & Nasution, U. H. (2022). Analisis Kinerja Keuangan Perusahaan Sebelum dan Setelah Penyebaran Covid-19 (Studi Kasus pada Perusahaan Yang Tercatat di Bursa Efek Indonesia). Jurnal Ilmiah Universitas Batanghari Jambi, 22(1), 631–635. http://dx.doi.org/10.33087/jiubj.v22i1.1788

Kasmir. (2016). Pengantar Manajemen Keuangan (2nd ed.).

Meythi, En, T. K., & Rusli, L. (2011). Pengaruh Likuiditas dan Profitabilitas Terhadap Harga Saham Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia. Jurnal Bisnis Manajemen Dan Ekonomi, 10(2), 2671–2684. http://repository.maranatha.edu/

Muzdalifah, S., Maslichah, & Afifudin. (2021). Perbandingan Harga Saham dan Volume Perdagangan Saham Sebelum dan Saat Covid-19 pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia. E-JRA, 10(01).

Natalia, Y. (2022). Perbandingan Kinerja Profitabilitas Sektor Hotel, Restoran, Dan Pariwisata Sebelum Dan Selama Pandemi Covid-19. Media Akuntansi dan Perpajakan Indonesia, 3(2), 91-102 https://doi.org/10.37715/mapi.v3i2.2397

Rinofah, R., Evany, S. T.,& Prima Sari, P. (2021). Analisis Profitabilitas Perusahaan Kompas 100 Sebelum dan Saat Pandemi Covid-19. Al-Kharaj : Jurnal Ekonomi, Keuangan & Bisnis Syariah, 4(2), 397–414 https://doi.org/10.47467/alkharaj.v4i2.678

Simatupang, F. L. (2021). Pengaruh Return on Asset, Debt to Asset Ratio, Quick Ratio, dan Total Asset Turn Over terhadap Harga Saham pada Perusahaan Sektor Kimia yang Terdaftar di Bursa Efek Indonesia. Skripsi. Universitas Muhmmadiyah Sumatera Utara. Medan.

Sinaga, A. N., Go, C. C., & Chandra, A. A. (2022). Pengaruh Net Profit Margin, Return On Assets, Cash Ratio, Dan Debt To Equity Ratio Terhadap Harga Saham Pada Perusahaan Sub Sektor Telekomunikasi, Makanan & Minuman, Dan Perdagangan Eceran Pada Masa Pandemi Covid-19 Di Bursa Efek Indonesia. Management Studies and Entrepreneurship Journal, 3(2), 413–429.

Tandelilin, E. (2017). Manajemen Portofolio & Investasi. PT. Kanisius.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Ronald N Girsang

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.